Market Snapshot: ERCOT Forward Market Transition from Backwardation to Contango in 2025

Published:

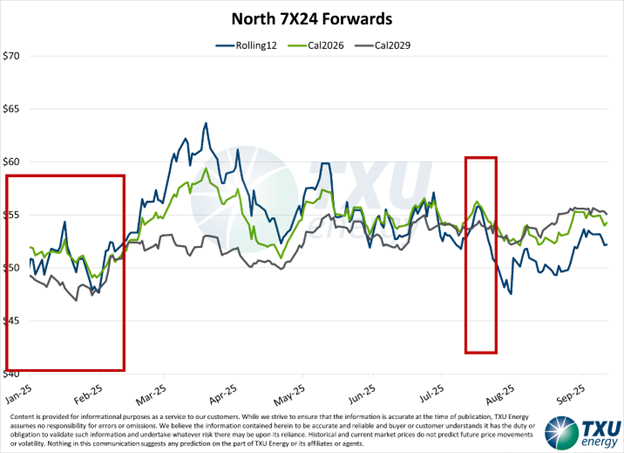

In 2025, ERCOT’s forward power market moved between Backwardation and Contango states, which shifts the cost advantage between long-term and short-term contracts. For energy buyers, these moves highlight the importance of staying alert to market signals when making procurement decisions.

In energy trading, Contango occurs when forward (futures) prices are higher than current spot prices, making longer-term energy contracts more expensive than short-term commitments. Backwardation is the opposite: forward prices are lower than spot prices, making long-term contracts more appealing.

From late fall 2024 through early 2025, ERCOT forward strips fluctuated between both market states. By February 2025, prices stabilized in Backwardation, presenting attractive long-term buying opportunities for customers ready to lock in forward rates.

However, in July 2025, the market rapidly shifted back to Contango in just one week, indicating that short-term deals may now offer more competitive pricing than longer-dated terms. This Contango structure persisted through the first part of September 2025.

Takeaway for Energy Buyers:

When shaping your procurement strategy, recognize that while energy market movements are critical, total cost of supply also reflects other components, such as transmission and distribution charges, and ancillary costs. A well-balanced strategy integrates forward market trends, non-energy cost drivers, and contract term length optimization.

If you’d like to learn how to apply these market insights to your energy procurement strategy, contact your TXU Energy Sales Executive or email us at business@txu.com.